Cell Phone Insurance Plans Compared: What's Worth It?

Cell phone insurance plans compared: What'southward worth information technology?

Updated January. ix: Verizon is increasing the monthly pricing for its Total Mobile Protection to $13, upwardly from $11. The change accompanies lower deductibles, and will take effect beginning Jan. 25 for new subscribers and March vi for existing ones.

Smartphones are at the centre of our lives. And given all the data stored inside — everything from our contacts and appointments to photos and songs — if anything happens to your phone, it can really disrupt your life. That includes those times when your smartphone gets lost, stolen or damaged.

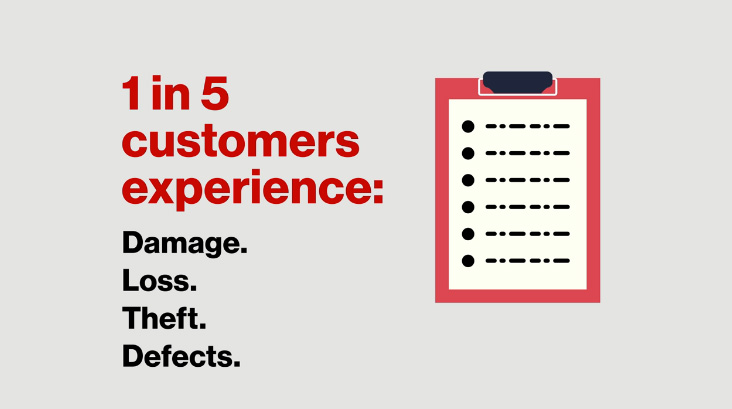

Mobile-phone insurance is meant to help yous during a phone crunch, regardless of what hardship impacts your device. Merely like any other type of insurance, it will price yous. Many consumers forgo the extra monthly payments of insurance and hope that they don't go one of the 35 percent who break or damage their devices within the get-go year.

Is that a smart decision? Or is mobile-phone insurance really worth the extra coin? Here's some info to consider if you're mulling over insuring your device.

Who should go telephone insurance?

If you've been living without phone insurance and have never had a trouble, yous might think it'southward a waste. Afterwards all, if everything's been going well upwardly to this point, why pay hundreds of dollars on a solution you might never demand?

More: Best Smartphones - Here Are the ten All-time Phones Available

But the truth is, that's probably a bad attitude to have. Information technology simply takes i drop to brand you wish you had smartphone insurance. And if y'all're particularly prone to slippery fingers, information technology'southward a must-have.

Many people today buy expensive smartphones, similar the iPhone viii or the Samsung Galaxy Notation 8. And when they do, they're opening themselves up to the possibility of spending a significant sum on fixes to their damaged devices. An iPhone 8, for instance, can cost $699. A cleaved screen out of warranty tin toll you lot $129 ($149 for the iPhone eight Plus and $279 for an iPhone Ten). Insurance immediately becomes worth it after simply 1 incident.

Information technology tin can be confusing to sort through the many mobile-phone insurance plans bachelor, not to mention all of the fine impress and fees yous'll take to pay over the lifetime of your smartphone.

Below, we break down the almost popular insurance plans from manufacturers, wireless carriers and third parties to see how much protection you're really buying, and if it's worth the actress money.

I. AppleCare+ vs. Samsung Premium Care

Let's look at the toll of insuring an iPhone 8. The iPhone 8 will cost you $699 to start. You can go directly to Apple to insure an iPhone viii Plus or older and buy AppleCare+ for $129, only y'all must do and then within the first 30 days of your buy. AppleCare+ for an iPhone X is $199. Every iPhone comes with a standard ane-yr warranty from Apple, but adding AppleCare+ extends that warranty to two years. Note that this plan isn't spread-out. For ii years, Apple will cover accidental damage (think dropping your phone or spilling water on it) and wear-and-tear, and provide up to 2 replacement devices.

Apple vs. Samsung Comparing (over 24 months)

| Manufacturer Plan | Protection Program Toll | Cost per Claim | Total (bold one claim) |

|---|---|---|---|

| AppleCare+ | $129 or $199 | $99 | $228 or $298 |

| Samsung Premium Intendance | $144 | $99 | $243 |

For both of these replacement claims, you volition be charged a $99 service fee plus tax. Then contrary to popular belief, your replacement telephone nether AppleCare+ will not be free. It's also important to annotation that AppleCare+ doesn't embrace theft.

MORE: Best iPhone eight Cases

What near Android phones, like the $930 Samsung Galaxy Note 8? Similar to Apple'southward protection plan, yous can add Samsung Premium Care to the latest Samsung smartphones (including the Galaxy S8, Galaxy S8+, and Galaxy Note eight) in add-on to a carrier'south warranty. Samsung Premium Care extends the original one-yr warranty to two years, and covers accidental damage, and operational or mechanical breakdowns. You also go far-person back up, but yous can pay for it in monthly payments of $eleven.99 rather than pay one lump sum. Like AppleCare+, Premium Care doesn't protect your smartphone if it gets lost or stolen.

2. Wireless Carrier Protection Programs

Phone insurance plans offered by carriers such as AT&T, Sprint, T-Mobile and Verizon typically follow the same blueprint: a monthly fee, a deductible for certain claims yous make and an equipment limit per claim. Here's a look at the costs across each big carrier, followed by detailed descriptions of each company'south program.

Carrier Comparing (over 24 months)

Apple iPhone eight or Samsung Milky way S8

| Carrier | Protection Programme Toll per Month | Cost per Claim | Total (bold 1 claim) |

|---|---|---|---|

| AT&T | $9 | $225 | $441 |

| Sprint | $xiii | $200 | $512 |

| T-Mobile | $10 | $175 | $415 |

| Verizon | $13 | $89 | $401 |

Apple iPhone 10

| Carrier | Protection Plan Cost per Month | Price per Merits | Full (assuming 1 claim) |

|---|---|---|---|

| AT&T | $nine | $299 | $515 |

| Sprint | $17 | $250 | $658 |

| T-Mobile | $10 | $275 | $515 |

| Verizon | $13 | $149 | $461 |

AT&T Mobile Protection Pack

AT&T offers three protection plans. The cheapest one will price you $8.99 per month. That will cover your phone for loss, theft, accidental damages and out-of-warranty malfunctions, and it includes next-twenty-four hours replacement of your smartphone.

The higher-end Mobile Protection Pack costs $x.99 per month and adds ProTech support (unlimited adept technical back up) and the ability to back up your photos, videos and contacts. The option even includes smartphone locking and erasing. The Multi-Device Protection Pack is best for families. It costs $29.99 per month and covers three devices on your plan and allows for upward to six claims per twelvemonth. All of the other plans let for ii claims per year.

Sprint Full Equipment

Sprint's Total Equipment Protection plan costs $9 per month and protects against loss, theft, and physical and liquid impairment. It besides comes with automatic fill-in services for up to 5GB. If you have a college-cease device, however, you'll need to upgrade to Sprint'south Total Equipment Protection Plus, which costs $xiii a month. It comes with all of the aforementioned features as the standard pick just boosts fill-in storage to 25GB and includes online device and tech support.

T-Mobile Premium Handset Protection

T-Mobile's Premium Device Protection costs $12 per month and covers a "premium" smartphone'due south loss, breakdown and theft. Pricing varies depending on the device you lot have.

T-Mobile also throws in Spotter Mobile Security Premium for iPhone owners who subscribe to the service.

If you purchase your phone through T-Mobile'south Jump! programme, yous pay $12 per calendar month and get everything that Premium Handset Protection offers, in addition to your Bound! upgrades to a new phone.

If you're not interested in special services — like remote wipe, app scanning, and backup for contacts and photos — you lot can choose T-Mobile's standard Device Protection plan, which costs $10 per month.

Earlier this twelvemonth, T-Mobile announced that AppleCare services are available for all of its Premium Device Protection offerings at no additional accuse. It'south the only carrier to offer AppleCare equally part of its insurance plan.

Verizon Extended Equipment Coverage

Verizon offers a few protection plans. The simplest option, Extended Warranty, comes with a $3 monthly cost per device. Yous must enroll in the program within 30 days, and it covers a replacement only if your telephone suffers a defect afterward the manufacturer's warranty has expired.

Verizon's Wireless Protection Plan costs $7.15 per month and adds coverage for lost, stolen and damaged smartphones. Simply again, you lot'll need to sign upwardly within thirty days of buying your phone. Finally, if you want Verizon's $thirteen-a-month Total Mobile Protection, y'all can go all of the advantages of the Wireless Protection Plan and also ensure coverage on a broken handset. For both the Wireless Protection Plan and the Total Equipment Coverage plan, you'll need to pay a deductible that varies depending on the handset. You're immune upwardly to three replacements in a 12-month period, with a maximum claim up to $i,500.

Carrier recommendation

By our calculations, Verizon has the cheapest protection plan of these carriers by far, costing as little equally $401 over 24 months to insure an iPhone 8 and Milky way S8. Similar to the other carriers we researched, Verizon has a pretty thorough plan that protects your smartphone against loss, theft and physical damages. In fact, carrier plans are the only ones we found that protect your smartphone in cases of loss and theft; third-party providers, and some manufacturers, do not.

More: Smartphone Buying Guide: 9 Tips for Finding the Right Phone

Three. 3rd-Political party Protection Plans

If neither your manufacturer'south insurance plan nor your carrier'south insurance plan satisfies you, there are tertiary-party insurance providers that tin can protect your smartphone. Ane of them, SquareTrade, covers adventitious impairment due to things like drops and spills, and mechanical malfunctions. It doesn't, however, encompass loss or theft, and yous won't receive any technical support .

SquareTrade'south pricing varies depending on your device, and the company charges an almanac fee rather than a monthly one. A two-year programme will set you back $129.

3rd-Party Provider Comparison (over 24 months)

Apple iPhone 8

| Carrier | Protection Program Cost | Price per Claim | Total (bold i merits) |

|---|---|---|---|

| SquareTrade | $129 (24 months) | $99 | $228 |

| Geek Squad | $96 | $150 | $246 |

Samsung Milky way S8

| Carrier | Protection Plan Cost | Cost per Merits | Full (bold i merits) |

|---|---|---|---|

| SquareTrade | $129 (24 months) | $99 | $228 |

| Geek Squad | $96 | $150 | $246 |

Best Buy's Geek Team besides gets into the smartphone insurance mix with the company'due south Geek Squad Protection. It offers protection for up to two years on everything from drops and spills to battery replacements. You can even transfer the program to someone else.

The service costs $seven.99 per calendar month. If you want loss and theft coverage, you'll need to pay $10.99 a calendar month for Geek Squad'southward Complete Protection, which as well includes all of the features in the standard option.

Third-party provider recommendation

Geek Squad and SquareTrade take comparably priced plans over 24 months, but SquareTrade is a meliorate value for protecting your handset. Notwithstanding, though SquareTrade offers a cheaper option, Geek Squad volition cover you in the event of theft or loss if you're willing to pay a bit more.

MORE: The Best iOS Apps You're Not Using (Simply Should Be)

Our Overall Recommendations

If you decide y'all want mobile-telephone insurance, you should examine the coverage of each programme you're considering and figure out where you desire the bulk of your money to get and what you are willing to sacrifice. If you lot're more probable to drop your smartphone than to misplace it, effort to save a few bucks and get with a third-party company such as SquareTrade, which will reduce your overall cost.

However, if you're a T-Mobile customer, you lot'll get a solid deal from the visitor with both smartphone protection and AppleCare services. And although pricing tin can be all over the place with wireless carriers, they do offering some of the quicker service in this roundup.

There are reasons to opt for smartphone manufacturers for insurance: They have the tools needed to gear up your device, they are experts at addressing problems, and overall, their pricing isn't too much more than what you'd find in alternative services.

The bottom line: You need to evaluate how much you want to spend, which companies you feel near comfortable with and the problem yous're most likely to take accept with your handset. Are you decumbent to losing your smartphone? Go with a company that offers theft and loss protection. Are you not so worried about losing your handset but you're concerned about having easy access to repair professionals? A third-party provider might not be for you lot. Ultimately, equally with whatsoever other kind of insurance, smartphone insurance takes some homework.

- Best Smartphones - Here Are the 10 Best Phones Available

- The Best iOS Apps You're Not Using (But Should Exist)

- Best Portable Charger - Battery Packs for Phones

Source: https://www.tomsguide.com/us/cell-phone-insurance-guide,news-19710.html

Posted by: hamelsist1975.blogspot.com

0 Response to "Cell Phone Insurance Plans Compared: What's Worth It?"

Post a Comment